RIA Money Transfer vs PandaRemit: Fees, Speed & Coverage Compared

Benjamin Clark - 2025-09-28 14:53:31.0 15

Introduction

International money transfers are essential for families, students, and businesses across the globe. With more people relying on digital platforms, two names frequently come up: RIA Money Transfer (https://www.riamoneytransfer.com/) and PandaRemit (https://www.pandaremit.com/). Both services provide accessible, user-friendly options for sending funds abroad.

As highlighted by Wikipedia (https://en.wikipedia.org/wiki/Remittance), remittances play a crucial role in supporting global economies and family livelihoods. By comparing RIA Money Transfer vs PandaRemit, we can better understand which platform offers the best value, convenience, and security for different users.

Fees and Costs

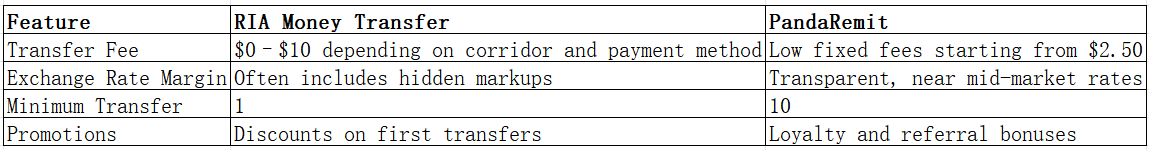

One of the first things users consider is how much it costs to send money abroad.

RIA may offer low upfront fees in some corridors, but hidden exchange rate markups can reduce the final amount received. PandaRemit, on the other hand, emphasizes transparency, with minimal hidden charges and consistently low fees.

Exchange Rates

Exchange rates often determine whether a transfer is cost-effective.

-

RIA Money Transfer: Rates can fluctuate and often include a margin above the mid-market rate. This can make transfers slightly more expensive over time.

-

PandaRemit: Offers exchange rates close to the mid-market value, ensuring recipients receive more money. Transparency is a core focus, so users know exactly how much will be delivered.

For frequent remittances, PandaRemit’s favorable rates can add up to significant savings.

Speed and Convenience

How fast money arrives is critical for urgent needs.

-

RIA Money Transfer: Offers cash pickup, bank deposits, and mobile wallet transfers. Depending on the destination, transfers can be instant, though many take 1–2 business days.

-

PandaRemit: Focuses on digital-first solutions, with instant or same-day transfers in most supported corridors. Its mobile app and website are streamlined for ease of use, with real-time tracking available.

Users who value fast, app-based convenience often find PandaRemit more reliable for quick transfers.

Safety and Security

Security is non-negotiable when handling cross-border payments.

-

RIA Money Transfer: Backed by Euronet Worldwide, RIA is regulated in multiple regions and implements standard financial security practices.

-

PandaRemit: Uses advanced encryption, two-factor authentication, and complies with international financial regulations to ensure safe and secure transactions.

For additional information on protecting your money when sending funds abroad, visit Consumer Finance (https://www.consumerfinance.gov/).

Global Coverage

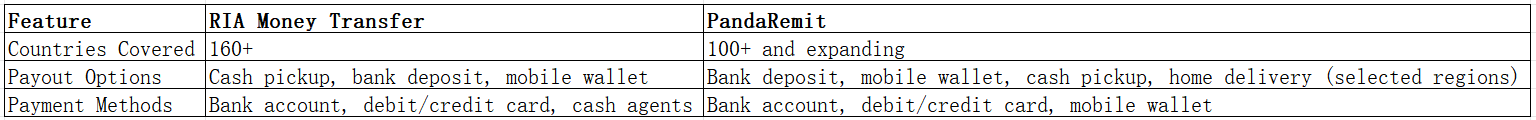

Coverage determines how widely accessible a service is.

RIA’s extensive network of agents makes it convenient for users who prefer cash pickups, especially in rural regions. PandaRemit, while covering fewer countries, emphasizes digital transfers and offers flexible payout methods for modern users.

Which One is Better?

When evaluating RIA Money Transfer vs PandaRemit, the right choice depends on your priorities:

-

Choose RIA Money Transfer if: You need cash pickups in rural areas or value its long-standing global presence.

-

Choose PandaRemit if: You prioritize low fees, competitive exchange rates, digital convenience, and fast transfers.

For most users looking for affordability and transparency, PandaRemit delivers a stronger overall experience.

Conclusion

In the comparison of RIA Money Transfer vs PandaRemit, both platforms provide trustworthy remittance services. RIA stands out with its extensive cash pickup network and long history, while PandaRemit excels with lower costs, transparent exchange rates, and enhanced digital convenience.

If you want a service that balances affordability, speed, and security, PandaRemit may be the better choice. Learn more and start your next transfer directly on PandaRemit’s official website: https://www.pandaremit.com/